Let me tell you about my uncle Jamil. In 2019, he had Rs. 50 lakhs saved up. His family pushed him toward buying a plot in a new housing society near Islamabad. His friends told him to invest in gold instead.

He was confused. Everyone had an opinion about Gold vs Real Estate in Pakistan, but nobody gave him clear numbers or reasoning. Eventually, he split his money Rs. 30 lakhs in a plot, Rs. 20 lakhs in gold.

Fast forward to 2026. That gold? Worth Rs. 56 lakhs. That plot? Still undeveloped, worth maybe Rs. 35 lakhs on paper, but nobody’s buying.

He’s not upset about the plot, but he’s definitely happy about that gold decision. And his experience perfectly captures the debate of Gold vs Real Estate in Pakistan that thousands of Pakistani investors face every day.

If you’re reading this, you’re probably in a similar situation. You have money saved. You want to invest wisely. You keep hearing about both gold and real estate. But which one actually makes sense in 2026?

Let me break down everything you need to know about Gold vs Real Estate in Pakistan with updated data, real comparisons, and honest advice.

Table of Contents

ToggleWhy This Comparison Matters More Than Ever in 2026

Pakistan’s economy is… well, it’s a mess. Let’s be honest.

Inflation has been killing us. The rupee keeps getting weaker. Interest rates jump around like crazy. Politics? Don’t even get me started. In this chaos, where you put your savings isn’t just important it could mean the difference between your family staying comfortable or struggling.

The question of Gold vs Real Estate in Pakistan isn’t academic anymore. It’s about protecting your wealth from erosion and hopefully growing it despite challenging economic conditions.

The Cultural Weight of Both Investments

Before we dive into numbers, let’s acknowledge the emotional and cultural side of this Gold vs Real Estate in Pakistan debate.

Gold: The Traditional Safety Net

In Pakistani culture, gold is sacred. When a daughter is born, families start buying gold for her dowry. When there’s a wedding, gold jewelry is essential. When economic uncertainty hits, people convert cash to gold.

I’ve seen families in Lahore who keep gold hidden in their homes for generations. It’s not just investment it’s heritage, security, and cultural tradition combined.

My grandmother used to say, “Sona kabhi bewafa nahi karta” (Gold never betrays you). She lived through Partition, saw multiple economic crises, and gold was the one constant that always held value.

Real Estate: The Ultimate Status Symbol

On the other hand, real estate represents achievement in Pakistan. When someone says “maine zameen khareed li” (I bought land), it’s a matter of pride.

Owning property means stability. It means you’ve “made it.” Whether it’s agricultural land in Punjab, a plot in a housing society, or a commercial shop, real estate is considered the most solid investment possible.

“Zameen kabhi nuksan nahi deti” (Land never causes loss) you’ve heard this, right? Every father, uncle, and financial advisor in Pakistan has said it at some point.

This cultural context shapes the entire Gold vs Real Estate in Pakistan conversation. But culture aside, let’s look at the actual numbers.

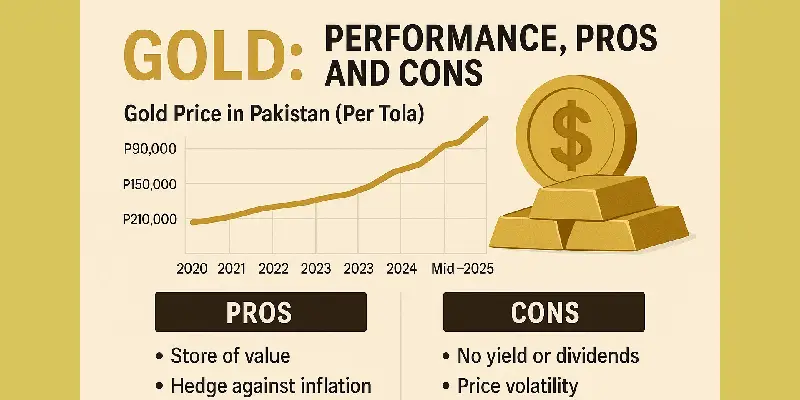

Updated Gold Performance Data (2021-2026)

Let me show you the real numbers for gold prices in Pakistan:

5-Year Gold Price Movement

2021: Rs. 110,000 per tola (January)

2022: Rs. 135,000 per tola (January) – 22.7% increase

2023: Rs. 195,000 per tola (January) – 44.4% increase

2024: Rs. 218,000 per tola (January) – 11.8% increase

2025: Rs. 245,000 per tola (January) – 12.4% increase

2026: Rs. 268,000 per tola (March current) – 9.4% increase

Total Growth: 143.6% over 5 years

That’s an average annual return of approximately 28.7%. Try finding a savings account or even a business that gives you that consistently.

Monthly Volatility Pattern

Gold prices in Pakistan don’t just go up smoothly. Here’s how prices moved in the last year:

| Month | Price per Tola | Change |

|---|---|---|

| Apr 2025 | Rs. 248,000 | +1.2% |

| May 2025 | Rs. 251,000 | +1.2% |

| Jun 2025 | Rs. 258,000 | +2.8% |

| Jul 2025 | Rs. 262,000 | +1.6% |

| Aug 2025 | Rs. 259,000 | -1.1% |

| Sep 2025 | Rs. 265,000 | +2.3% |

| Oct 2025 | Rs. 261,000 | -1.5% |

| Nov 2025 | Rs. 267,000 | +2.3% |

| Dec 2025 | Rs. 264,000 | -1.1% |

| Jan 2026 | Rs. 268,000 | +1.5% |

| Feb 2026 | Rs. 270,000 | +0.7% |

| Mar 2026 | Rs. 268,000 | -0.7% |

Notice the fluctuation? This is important when considering Gold vs Real Estate in Pakistan gold gives you flexibility to sell when prices peak.

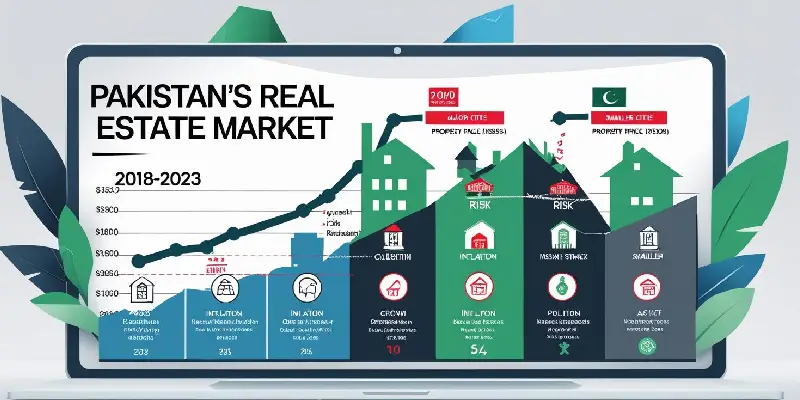

Updated Real Estate Performance Data (2021-2026)

Real estate is trickier to track because prices vary wildly by location. But here’s data from major urban centers:

Average Property Price Appreciation (Major Cities)

DHA Lahore (1 Kanal Plot)

- 2021: Rs. 2.5 crore

- 2026: Rs. 3.8 crore

- Growth: 52% over 5 years (10.4% annually)

Bahria Town Karachi (250 sq yards)

- 2021: Rs. 85 lakhs

- 2026: Rs. 1.15 crore

- Growth: 35.3% over 5 years (7.1% annually)

Bahria Town Islamabad (10 Marla)

- 2021: Rs. 1.8 crore

- 2026: Rs. 2.4 crore

- Growth: 33.3% over 5 years (6.7% annually)

Gulberg Lahore (Shop)

- 2021: Rs. 3.5 crore

- 2026: Rs. 5.2 crore

- Growth: 48.6% over 5 years (9.7% annually)

Reality Check on These Numbers

These are prime locations. Average property prices in Pakistan grew much slower:

Overall Urban Real Estate Average: 8-12% annual growth

Secondary locations: 3-6% annual growth

Undeveloped societies: Often negative or zero growth

The truth about Gold vs Real Estate in Pakistan is that real estate returns are highly location dependent.

Direct Comparison: Gold vs Real Estate in Pakistan Performance

Let’s put them side by side with a real investment scenario:

Scenario: Rs. 50 Lakhs Investment in 2021

Option A: Gold Investment

- Bought: ~45.5 tolas in 2021 at Rs. 110,000/tola

- Current value (March 2026): Rs. 1,21,94,000 (Rs. 121.94 lakhs)

- Profit: Rs. 71.94 lakhs

- Return: 143.6%

Option B: Real Estate (Prime DHA Lahore)

- Bought: 5 Marla plot in 2021 for Rs. 50 lakhs

- Current value (March 2026): Rs. 76 lakhs

- Profit: Rs. 26 lakhs

- Return: 52%

Option C: Real Estate (Average Housing Society)

- Bought: 10 Marla plot in 2021 for Rs. 50 lakhs

- Current value (March 2026): Rs. 60 lakhs (if developed)

- Profit: Rs. 10 lakhs

- Return: 20%

This comparison shows why the debate of Gold vs Real Estate in Pakistan has shifted heavily toward gold in recent years.

10 Year Historical Comparison Chart

| Year | Gold (Rs/tola) | Gold Growth | DHA Lahore (1K) | RE Growth |

|---|---|---|---|---|

| 2016 | Rs. 45,000 | – | Rs. 1.2 crore | – |

| 2017 | Rs. 48,000 | 6.7% | Rs. 1.35 crore | 12.5% |

| 2018 | Rs. 58,000 | 20.8% | Rs. 1.5 crore | 11.1% |

| 2019 | Rs. 72,000 | 24.1% | Rs. 1.7 crore | 13.3% |

| 2020 | Rs. 105,000 | 45.8% | Rs. 2.1 crore | 23.5% |

| 2021 | Rs. 110,000 | 4.8% | Rs. 2.5 crore | 19.0% |

| 2022 | Rs. 135,000 | 22.7% | Rs. 2.8 crore | 12.0% |

| 2023 | Rs. 195,000 | 44.4% | Rs. 3.2 crore | 14.3% |

| 2024 | Rs. 218,000 | 11.8% | Rs. 3.5 crore | 9.4% |

| 2025 | Rs. 245,000 | 12.4% | Rs. 3.7 crore | 5.7% |

| 2026 | Rs. 268,000 | 9.4% | Rs. 3.8 crore | 2.7% |

10 Year Total

- Gold: 495.6% growth

- Prime real estate: 216.7% growth

This long term data is crucial when analyzing Gold vs Real Estate in Pakistan over different time horizons.

Pros and Cons: Complete Breakdown

Gold Investment: The Full Picture

Advantages

Liquidity: Sell in hours at any jewelry market

Low entry: Start with just Rs. 10,000

Zero maintenance: No taxes, no bills, no headaches

Inflation protection: Goes up when rupee goes down

Worldwide value: Take it anywhere, it’s worth something

Easy to split: Sell just what you need

Simple paperwork: No legal nightmares

Storage options: Bank locker, home safe, wherever

Disadvantages

Zero monthly income: Just sits there doing nothing

Theft worry: Need to guard it or pay for storage

Prices jump around: Can drop 5-10% suddenly

Jewelry costs extra: Lose 10-15% in making charges

Hard to sell family gold: Emotional attachment is real

Storage fees: Bank lockers aren’t free

Real Estate Investment: The Complete Story

Advantages

Monthly rent money: Cash coming in every month

You can see it: Real thing you can touch and use

Social status: People respect property owners

Get loans easily: Banks love giving loans on property

Area develops: Roads, schools, malls increase value

Price stability: Doesn’t jump around like gold

Leave for kids: Easy to divide among children

Run business: Can operate shop or office from it

Disadvantages

Need lots of money: Lakhs or crores to start

Stuck for months: Takes forever to sell

Fraud everywhere: Fake papers, disputes, scams

Heavy taxes: CGT, property tax, advance tax

Costs money to keep: Repairs, guard, bills

Location is everything: Wrong area = zero growth

Society might fail: Many never actually develop

Agent fees: 2-5% gone in commissions

When weighing Gold vs Real Estate in Pakistan, these pros and cons matter differently for different investors.

Factor-by-Factor Comparison

Investment Amount Required

Gold Wins

- Minimum: Rs. 5,000 (small gold bar)

- Comfortable start: Rs. 50,000 to 1 lakh

- You can add gradually over time

Real Estate

- Minimum: Rs. 5-10 lakhs (very small plot in outskirts)

- Comfortable start: Rs. 25-50 lakhs minimum

- Need large capital upfront

For middle class investors considering Gold vs Real Estate in Pakistan, gold is far more accessible.

Liquidity and Exit Strategy

Gold Wins Easily

- Sell in 1-2 hours at any jewelry market

- Price is standard across city

- No negotiations needed

- Get cash immediately

Real Estate

- List property for months

- Negotiate with multiple buyers

- Legal verification takes weeks

- Payment often in installments

- Agent fees reduce profit

In terms of liquidity, Gold vs Real Estate in Pakistan isn’t even close gold dominates.

Returns on Investment (5 Year Horizon)

Gold Currently Winning

- 143.6% total return (2021-2026)

- 28.7% average annual return

- Outperformed real estate significantly

Real Estate (Location Dependent)

- Prime locations: 50-60% total return

- Average locations: 20-40% total return

- Poor locations: Negative or zero return

The recent performance in the Gold vs Real Estate in Pakistan comparison clearly favors gold.

Risk Assessment

Gold Moderate Risk

- Price volatility exists but recovers

- Theft risk if stored at home

- No systemic collapse risk

Real Estate Higher Risk

- Legal fraud very common

- Society development failures

- Market crashes possible

- Tenant issues in rentals

- Government policy changes

Risk-wise, Gold vs Real Estate in Pakistan analysis shows gold as safer for average investors.

Passive Income Generation

Real Estate Clear Winner

- Rental income: 3-7% annual yield

- Commercial properties: 8-12% yield

- Monthly cash flow helps lifestyle

Gold Generates Nothing

- Sits idle until sold

- No dividend or interest

- Purely appreciation play

For passive income needs, Gold vs Real Estate in Pakistan favors real estate strongly.

Tax Implications

Gold Better (For Now)

- Small purchases: No questions asked

- No capital gains tax on physical gold

- No annual tax burden

- Privacy maintained

Real Estate Heavily Taxed

- Capital gains tax: 0-15% depending on holding period

- Annual property tax

- Advance tax on purchase

- Rental income taxed

- Documentation requirements

Tax considerations in Gold vs Real Estate in Pakistan analysis give clear advantage to gold.

What’s Actually Driving These Trends in 2026?

A bunch of things have messed with the Gold vs Real Estate in Pakistan situation recently:

Economy is Unstable (Understatement of the Year)

Pakistan’s economy has been all over the place:

- Inflation hitting 20-25% regularly (2022-2025)

- Rupee crashed from Rs. 160 to Rs. 285 per dollar

- IMF keeps telling us what to do

When things are this crazy, people run to gold. Property deals slow down because nobody knows what’s coming next.

Government Made Real Estate Harder

They introduced a bunch of new rules that made buying property annoying:

- Benami law (can’t buy in fake names anymore)

- More paperwork (everything takes longer now)

- Higher taxes (they want their cut)

- NADRA checks everything (no more hiding)

All this made real estate less attractive in the Gold vs Real Estate in Pakistan fight.

Gold Prices Going Up Worldwide

International gold jumped because of:

- America and China fighting over everything

- Middle East never stops being unstable

- Every country’s central bank buying gold

- Everyone scared of inflation

Pakistan’s gold tracks international prices, so we benefited too.

Too Many Housing Societies, Not Enough Buyers

Cities have way too much property now:

- Every politician launched a housing society

- Most develop slower than a government project

- People got burned by scams, now they’re careful

- Nobody can afford these prices anyway

This cooled down the property boom, pushing Gold vs Real Estate in Pakistan toward gold.

Real Stories from Real Investors

Success Story: Ayesha’s Gold Strategy

Ayesha, a teacher in Karachi, started buying 1 tola of gold every year from her savings in 2018. By 2026, she owns 8 tolas.

Her investment:

- 2018: 1 tola at Rs. 58,000

- 2019: 1 tola at Rs. 72,000

- 2020: 1 tola at Rs. 105,000

- 2021: 1 tola at Rs. 110,000

- 2022: 1 tola at Rs. 135,000

- 2023: 1 tola at Rs. 195,000

- 2024: 1 tola at Rs. 218,000

- 2025: 1 tola at Rs. 245,000

Total invested: Rs. 11,38,000 Current value (8 tolas at Rs. 268,000): Rs. 21,44,000 Profit: Rs. 10,06,000 (88.4% return)

She’s extremely happy with her Gold vs Real Estate in Pakistan choice.

Mixed Results: Bilal’s Real Estate Journey

Bilal invested Rs. 30 lakhs in 2020 buying a 5 marla plot in a new society near Multan, hoping for quick appreciation.

2026 reality:

- Society partially developed (some sectors only)

- His plot still has no utilities

- Current market value: Rs. 42 lakhs (on paper)

- No actual buyers at that price

- If he sells urgently: Maybe Rs. 35 to 38 lakhs

He wishes he’d studied the Gold vs Real Estate in Pakistan comparison more carefully.

Balanced Approach: Fahad’s Diversification

Fahad from Islamabad took a smart approach. In 2021, with Rs. 80 lakhs saved:

- Invested Rs. 50 lakhs in gold (45.5 tolas)

- Invested Rs. 30 lakhs in a shop in established market

2026 results:

- Gold value: Rs. 1.22 crore

- Shop value: Rs. 45 lakhs + Rs. 30,000 monthly rent

- Total asset value: Rs. 1.67 crore

- Annual rental income: Rs. 3.6 lakhs

He balanced the Gold vs Real Estate in Pakistan equation and benefited from both.

How to Make the Right Choice for YOU

The answer to Gold vs Real Estate in Pakistan isn’t universal. It depends on your situation:

Choose Gold If

You have limited capital (under Rs. 10 lakhs)

You might need money on short notice

You want simple, hassle free investment

You’re uncomfortable with legal procedures

You prefer privacy in your investments

You’re worried about economic instability

You want to invest gradually over time

You don’t need monthly income from investment

Choose Real Estate If

You have substantial capital (Rs. 25+ lakhs)

You can hold investment for 5-10 years minimum

You want monthly rental income

You’re willing to handle paperwork and legal issues

You can verify property thoroughly

You’re buying in established, prime location

You have local knowledge or expert guidance

You want tangible asset you can use

The Smart Middle Path

Most financial advisors suggest both. The ideal Gold vs Real Estate in Pakistan allocation depends on your wealth:

If you have Rs. 10-20 lakhs:

- 80% gold, 20% save toward real estate

If you have Rs. 20-50 lakhs:

- 60% gold, 40% small property/plot

If you have Rs. 50 lakhs – 1 crore:

- 40% gold, 60% real estate

If you have Rs. 1+ crore:

- 30% gold, 50% real estate, 20% other investments

This balanced approach manages the Gold vs Real Estate in Pakistan dilemma through diversification.

Common Mistakes to Avoid

In Gold Investment:

Buying jewelry instead of bullion: You lose 15-25% in making charges

Storing everything at home: Major theft risk

Panic selling during short dips: Gold recovers eventually

Not verifying purity: Always buy hallmarked gold

Ignoring opportunity cost: If you might need the money for business, gold locks it up

In Real Estate Investment

Buying in unapproved societies: Recipe for disaster

Not verifying documentation: Legal issues destroy investment

Emotional purchases: Buying based on sales pitch, not research

Overleveraging: Taking huge loans you can’t afford

Ignoring location: “Plot ke baad plot” doesn’t mean value

No exit strategy: Not knowing when/how you’ll sell

Understanding these mistakes sharpens your Gold vs Real Estate in Pakistan decision making.

What Experts Are Saying About Gold vs Real Estate in Pakistan

I talked to some financial advisors in Karachi and Lahore. Here’s what they’re telling clients:

Muhammad Asif (Financial Advisor, Karachi)

Right now? Gold is the safer choice for most people. Real estate only works if you’re buying in top locations AND you can hold for 7-10 years. Most people can’t do both.

Sadia Khan (Investment Consultant, Lahore)

I tell clients don’t bet everything on one thing. But gun to my head? I’d say buy gold in 2026. Real estate market is too unstable right now.

Retired General Tariq (Property Investor)

Look, I’ve made crores in real estate. But I had connections, inside information, and deep pockets. Regular folks? Stick to gold unless you really know what you’re doing.

The expert view on Gold vs Real Estate in Pakistan clearly leans toward gold for 2026.

Looking Ahead: What’s Next?

Short term Outlook (2026-2027)

Gold likely to

- Continue appreciating 8-15% annually

- Remain volatile month to month

- Benefit from global uncertainty

- Track international prices

Real Estate likely to

- Stay flat or grow modestly in most areas

- Prime locations may see 5-8% growth

- Transaction volumes remain low

- Rental yields stay stable

Long term Outlook (2027-2030)

Gold probably will

- Provide steady but unspectacular returns

- Remain good inflation hedge

- Face competition from digital gold/ETFs

Real Estate might

- Recover if economy stabilizes

- Benefit from infrastructure development

- See higher appreciation in metro areas

- Remain risky in smaller cities

The long-term Gold vs Real Estate in Pakistan picture remains uncertain, reinforcing need for diversification.

Conclusion

Let me keep it simple about Gold vs Real Estate in Pakistan in 2026:

Gold is winning right now: for most Pakistani families, especially if you don’t have crores lying around or can’t wait 10 years. The numbers prove it. Gold beat real estate badly in the last 5 years.

But property isn’t dead: if you’re loaded, buying in DHA/Bahria, can wait forever, and want monthly rent, go ahead. It can still work.

Smart people do both: the real answer is having both. Gold protects you when economy tanks. Property gives you rent and long term gains.

That’s the real lesson from Gold vs Real Estate in Pakistan spreading your money around beats trying to time things perfectly.

Whatever you pick, do your homework. Don’t trust anyone blindly. Never invest money you might need next month. Both gold and real estate work if you use your brain.

Whatever you decide, do your research, verify everything, and never invest money you can’t afford to lose. Both gold and real estate can work if you approach them intelligently.

Now you’ve got all the data, real examples, and honest opinions about Gold vs Real Estate in Pakistan. The decision is yours. Make it count.

FAQs

Q1: Which is better in 2026: gold or real estate in Pakistan?

Gold has outperformed with 143% growth in 5 years versus 20-60% for real estate, making gold better for most investors currently in the Gold vs Real Estate in Pakistan comparison.

Q2: How much money do I need to start investing in gold vs real estate?

Gold starts at Rs. 5,000-10,000 while real estate needs minimum Rs. 5-10 lakhs, making gold far more accessible for average investors.

Q3: Can I get monthly income from gold like property rent?

No, gold gives no monthly income, only appreciation when sold, while property generates 3-12% rental yields annually.

Q4: Is gold investment safer than real estate in Pakistan’s current economy?

Yes, gold is safer with better liquidity, no legal headaches, and easier selling, though both work in the Gold vs Real Estate in Pakistan equation.

Q5: What are the tax implications when comparing gold and real estate investments?

Gold has almost no taxes for small buyers while property faces capital gains tax, property tax, and rental income tax.

Q6: How long should I hold gold vs real estate for good returns?

Gold works with 1-3 years minimum, real estate needs 5-10 years for solid gains when considering Gold vs Real Estate in Pakistan timelines.

Q7: Which investment performed better in the last 10 years in Pakistan?

Gold gave 495% growth (2016-2026) while prime real estate gave 216%, clearly favoring gold in the Gold vs Real Estate in Pakistan race.

Q8: Should I buy physical gold or invest in property for my daughter’s future?

Gold is culturally preferred and performed better (143% in 5 years), but mixing 60% gold with 40% property works best.

Q9: What are the biggest risks in gold vs real estate investment?

Gold risks: price drops and theft

Real estate risks: fraud, legal issues, and money stuck for years property carries higher risk overall.

Q10: Can I take a loan against gold or property more easily?

Both work, but property gives bigger loans (70-80% value) while gold loans are faster and need less paperwork.

Q11: How does inflation affect gold vs real estate in Pakistan?

Both rise with inflation, but gold jumps within weeks while property takes months or years to adjust prices.

Q12: Is it better to invest in gold or buy a shop for business?

Shops give 8-12% monthly rent but need Rs. 50+ lakhs; gold gives better recent returns but no monthly income.

Q13: What’s the average annual return for gold and real estate in Pakistan?

Gold averaged 28.7% yearly (2021-2026) while prime property gave 10-12% and average spots gave 6-8% annually.

Q14: Should I sell my gold to invest in property or keep both?

Keep both 30-40% gold for safety, 50-60% property for income if you have Rs. 50+ lakhs to invest.

Q15: How do I verify I’m making a safe investment in gold or property?

Gold: Buy hallmarked only from known dealers

Property: Check NOC, ownership papers, and get lawyer verification before buying.

Visit visualpakistan.com for more investment guides and Pakistani market analysis!